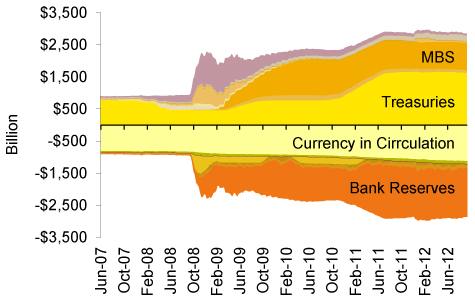

In the year 2008 the total value of equities traded in the world peaked at one hundred trillion dollars/$100,000,000,000,000 as compiled and reported by The World Bank. I can’t help myself to wonder if this is the amount of money that is bought, and sold on a year to year basis. Clearly one hundred trillion dollars worth of stock can’t be traded year after year, by looking at the data provided by The World Bank you can’t help but question just how free America really is, most people would say 100 Trillion dollars is a substantial amount of money. Think about this in July of 2008 the total amount of public debt was somewhere around 5.40 Trillion dollars, just 5.40% of the 100 trillion dollars worth of stock traded in 2008, by looking at the data one can come to a conclusion that this was not a magical occurrence similar to the Big Bang fiasco. Scientists say that all matter, light and energy came from the Big Bang explosion. In many way’s i can see why many religious body’s/people would argue with many of the scientific theory’s scientist spew out time after time. In 2008 the U.S Government owed about 4.18 trillion dollars combined with the public debt of 5.40 trillion dollars this would justify the total U.S debt of 9.58 trillion dollars in July of 2008. In 2003 the total value of stocks traded was 29 trillion, in 2004 39 Trillion, 2005 47 trillion, 2006 67 trillion, in 2007 98 trillion, and finally in 2008 100 trillion but wait a second from 2008 to 2011 that number diminished to 66 trillion as you can see in this chart!  You can verify the data on your own by visiting the The Worlds Bank Website Here http://data.worldbank.org/indicator/CM.MKT.TRAD.CD/countries?cid=GPD_31&display=graph

You can verify the data on your own by visiting the The Worlds Bank Website Here http://data.worldbank.org/indicator/CM.MKT.TRAD.CD/countries?cid=GPD_31&display=graph

60 Trillion out of the 100 trillion in July of 2008 the United States of America was responsible for. That’s a whopping 60% share compared to the rest of the world of stocks traded.

If 50% of U.S debt was owed by the public in July of 2008 a person with the mental capacity to add 1 and 2 would give an answer of 3 if you to told that same person that they could borrow $100 as long as they paid 50% in 1 year that person would then ask? when do i pay the rest? as you can see obviously in July of 2008 the Government Owed the rest of the total debt at that specific time. let’s look at a picture, shall we.

You can verify this Data through Google Public Data https://www.google.com/publicdata/explore?ds=d5bncppjof8f9_&met_y=ny_gdp_mktp_cd&idim=country:USA&dl=en&hl=en&q=us%20gdp#!ctype=l&strail=false&bcs=d&nselm=h&met_y=cm_mkt_trad_cd&scale_y=lin&ind_y=false&rdim=region&idim=country:USA&ifdim=region&hl=en_US&dl=en&ind=false

You can verify this Data through Google Public Data https://www.google.com/publicdata/explore?ds=d5bncppjof8f9_&met_y=ny_gdp_mktp_cd&idim=country:USA&dl=en&hl=en&q=us%20gdp#!ctype=l&strail=false&bcs=d&nselm=h&met_y=cm_mkt_trad_cd&scale_y=lin&ind_y=false&rdim=region&idim=country:USA&ifdim=region&hl=en_US&dl=en&ind=false

Now let’s look at another very interesting chart that shows that shows of money is most time and energy is distributed in/out the most in real estate, insurance, rental, and leasing especially financial services. The chart is a bit out of date, not a big deal this chart sends the message i want to send

.

Troubled Asset Relief Program (TARP) is the program used by the U.S Treasury to bail out the following company’s with money it borrowed from the FEDERAL RESERVE at the cost of the U.S TAX PAYER

Banks & Financial Institutions 245 Billion

Auto Company’s 79 Billion

AIG 67 Billion

Toxic Asset Purchases 18 Billion

Mortgage MOD Program 4 Billion

State Housing Programs 1.5 Billion

Small Business Aid 368 Billion

FHA refinance program 50 million

The New York Times published this article detailing exactly who took the money, in many cases many did not need the money.

You can check it out here http://www.nytimes.com/packages/html/national/200904_CREDITCRISIS/recipients.html

However it is a coincidence that the U.S Government will be off 1.3 Trillion dollars in 2013, with it all starting in 2009 at 1.4 trillion dollars, 2010 1.3 trillion dollars, 2011 1.3 trillion dollars. America’s paid to bail out the Private Sector, and Wall Street. Interests from all over the world buy/sell out assets at TARP is the definition of wrong. It’s as simple as Toxic Moral Hazard. American’s should not be bailing out company’s who exchange value with other economies!

Now, let’s talk about the WAR ON TERROR witch by the way has thrown our budge out of balance

The War on Terror drove military spending to a new record of $671 billion in FY 2007. Despite declines in revenue, defense spending increased throughout the recession to fund the wars in Iraq and Afghanistan:

- FY 2009 – $782 billion.

- FY 2010 – $663 billion.

- FY 2011 – $895 billion.

- FY 2012 – $881 billion.

I feel confident in saying that the reason why the United States cannot pay its bills is because it spend too much money on a war it did not need to fight, and bailed out Wall Street witch by the way made more money than 100 trillion dollars. Wall Street trades financial instruments that are not publicly tracked, before the market collapsed Wall Street banks had created about 700 trillion dollars of derivatives (ABSs, CDOs, CMBSs, MBSs, OCOs, LCDSs) three letters it’s magically delicious. Wall Street made Trillions of dollars coming out of this mess they created now they want to crucify the middle class, and the poor. What’s that saying the rich use the middle class, the middle class frowns upon the poor. That’s exactly what’s going on its UN-American to the full extent, i feel bad for anyone driving with Obama/Romney stickers as you are completely ignorant as to what is really going on.